Blackbird Investment Group

Uncovering opportunities and unlocking value

About Blackbird

Blackbird Investment Group is a boutique real estate investment management firm based in Chicago, Illinois. We are a multi-disciplinary, value-oriented investor that targets undervalued, overlooked, complex, or mispriced assets. Our highly analytical approach combines local market knowledge and national capital markets expertise with economic and demographic data to uncover relative value opportunities and exploitable trends.

2014

Company Founded

18+

Years Principals Together

$1.3B+

Acquisitions to Date

6.3M+

Square Feet Acquired

About Blackbird

2014

Company Founded

$1.3B+

Acquisitions to Date

18+

Years Principals Together

6.3M+

Square Feet Acquired

Strategy

Blackbird’s investment strategy emphasizes capitalizing on current real estate market dynamics, adding value to investments in our portfolio and creating attractive returns at each stage of the investment cycle.

We concentrate on investments in properties where we can add value. We add value by increasing income through development, through releasing, repositioning, rehabilitating, and/or improving management, and through acting upon relative value opportunities among geographic, market, and property sectors created by capital market conditions. To access investment opportunities and create value in undervalued properties, we create partnerships with established local, regional, and national real estate owners and operators who value our real estate expertise, creativity, and collaboration to execute a business plan.

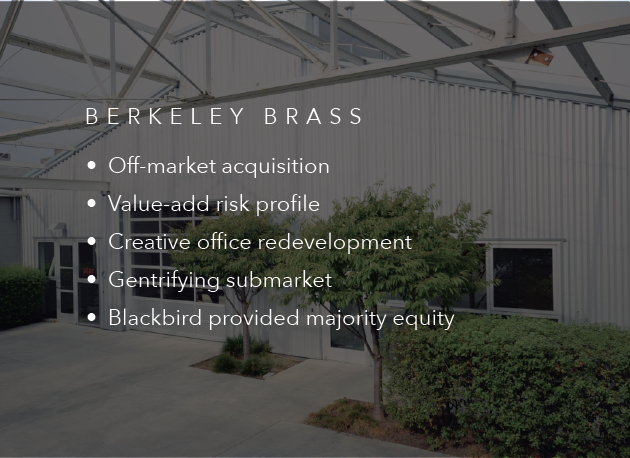

Profile

Our primary focus is the acquisition of sub-performing real assets with a clear path to upside through repositioning, restructuring, redeveloping, and/or improving management. Other opportunities considered include select ground-up development, sale-leasebacks, and build-to-suit transactions.

Structure

We provide a variety of equity capital solutions to our network of local operating partners ranging from controlling (majority equity), non-controlling (sponsor equity) and preferred equity positions (structured). Moderate use of leverage, typically from balance sheet lenders, is utilized.

Asset Classes

We consider investments in all asset classes with a focus on industrial, multifamily, and office properties. Additionally, we have exposure to and an interest in other asset classes including, but not limited to, student housing, life science, self-storage, retail, hospitality, and other mixed-use assets.

Geography

We invest across the U.S. with a focus on primary and secondary markets which have demonstrable growth characteristics, high barriers to entry, and liquidity. Our former/current portfolio of assets are located in the San Francisco Bay Area, Seattle, Chicago, Boston, Philadelphia, Baltimore, and Washington D.C.

Contact Us

Blackbird

Investment Group

350 W. Hubbard Street

Suite 250

Chicago, IL 60654

Tel : 312.724.8247

Fax: 312.724.8327

Investment Opportunities

Matt Jenson | Principal

Investor Inquiries

Todd Vender | Managing Partner

General Inquiries

Pete Hosfield | Chief Financial Officer